Investments

We look for sustained profitable and scalable business models acting in the food, luxury & consumer goods and technologie innovation industry with sound growth potential into new markets and/or product ranges.

Investment Philosophy & Strategy

Size of the Companies

Industrial Focus

Geographic Focus

Control

Investment Size

Portfolio Companies – Food Industry

Blattmann Schweiz AG – is a food ingredients company incorporated in 1856 with a focus on starches, organic glucose and organic gluten serving the food production industry for end consumer products such as baked-goods, sweets, dairy, meat, meat replacement and convenience products.

Investment year: 2012

Investment type: Equity

Industry sector: Food ingredients production for starches and glucose

Investment year: 2016

Investment type: Equity

Industry sector: Food Ingredients Trading

Blattmann Noredux – development and production but as well as toll manufacturing of specific dextrins and modified clean labels for the food industry.

Investment year: 2012

Legal spin off: 2023

Investment type: Equity

Industry sector: Food ingredients production for dextrins and clean labels

www.blattmannschweiz.com

Portfolio Companies – Technology Innovation

Investment year: 2012

Investment type: Equity

Industry sector: Cosmetics

Filag Medical Schweiz AG

Investment year: 2017

Investment type: Equity

Industry sector: Medical Skin Care

Portfolio Companies – Luxury and Consumer Goods

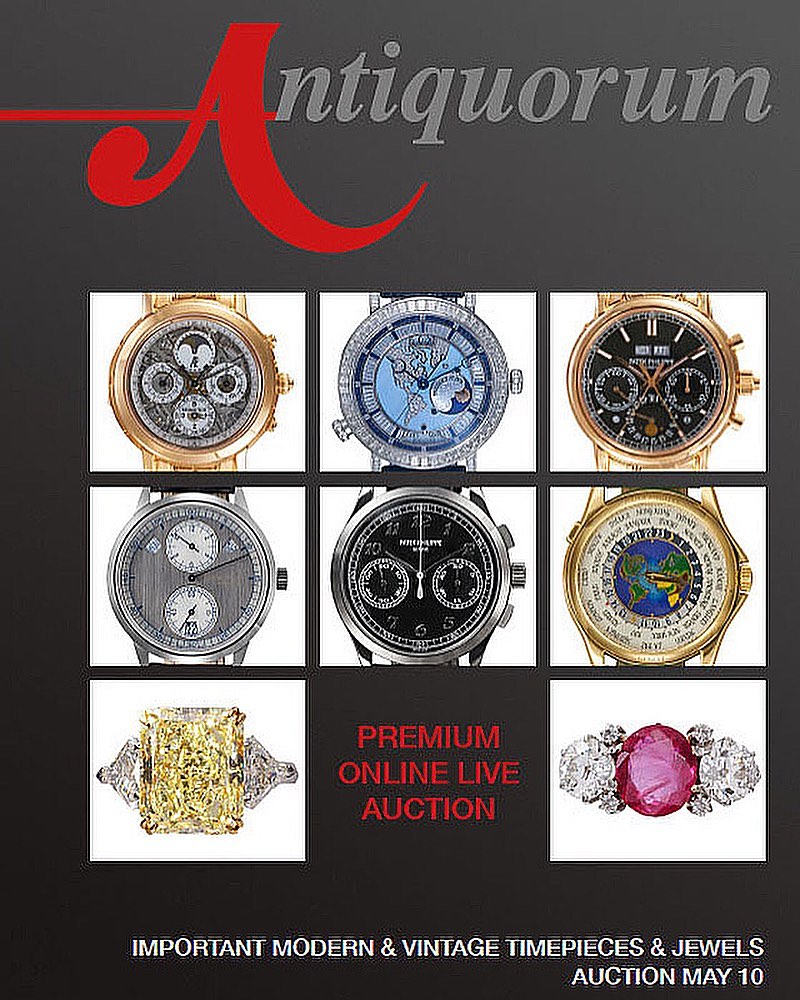

Antiquorum – Antiquorum is an auction house founded in Geneva, Switzerland in 1974, specializing in the auction of watches, clocks, and other collectibles. Antiquorum is renowned for having sold many of the world’s most valuable watches, including the world’s most expensive wristwatch, the Patek Philippe Henry Graves Supercomplication. Antiquorum holds auctions on a regular basis in Hong Kong, New York, Geneva and Monaco, offering a diverse range of timepieces, ranging from vintage and modern watches to antique clocks and pocket watches. Antiquorum has a leading position in the market and is ranked number 4 in the global auction market for modern and vintage timepieces.

Investment year: 2015

Investment type: Equity

Industry sector: Watch Auctioneer

Investment year: 2016

Investment type: Loan

Industry sector: Consumer Goods

Divested Portfolio Companies

Invertag/Gorba – Gorba AG is an information technology company headquartered in Switzerland. It is a global provider of complete passenger information systems consisting of software and hardware solutions that are designed for the public transportation sector.

Investment year: 2013 / 2014

Investment type: Equity

Industry sector: Passenger Information

Trade sale: 2016, Industrial Trade Sale